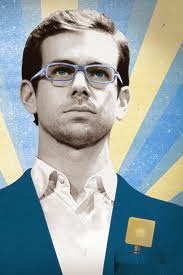

Jack Dorsey may shy from being called the

Steve Jobs of his generation, but there's no question he's on one hell of a hot streak, developing his latest creation Square Payments recently, and as the yellow of the fall is covering all the streets of Europe I might warn you to put those hard earned extra € into the next big IPO "Twitter" you will certainly more than double your money.

Square, the mobile-payments startup that's landed $340 million in venture capital, just moved into sprawling new offices in San Francisco after doubling its head count in less than a year. The new digs sit -- coincidentally, Dorsey insists -- a block from those of

Twitter, which he cofounded in 2006 and whose looming IPO figures to make Dorsey his second billion dollars in the past 13 months.

The 36-year-old declined to say much about Twitter, citing federal "quiet period" rules that precede an initial public offering of stock. But asked how it felt to have invented two products whose users number into the hundreds of millions worldwide, the entrepeneur allowed himself a moment of introspection.

"If you're climbing on the mountain, it doesn't look that massive to you," he said from the glass-and-wood accented Market Street headquarters into which CEO Dorsey and most of Square's 600 other employees moved last week.

Twitter made news of its own last week with its long-rumored IPO filing, which revealed the microblogging service has more than 200 million active monthly users. Square, meanwhile, claims to process $15 billion annually in credit card transactions -- not including a deal cut last year to handle all of Starbucks' card payments. Today while having my morning coffee at Starbuck´s I was just thinking this guy is going to make STAR BUCKS!!!

But, on Dorsey's words, "we don't feel we're at even 1 percent of our potential with either company."

Dorsey, a bachelor who grew up in a blue-collar St. Louis family, owns 5 percent of Twitter and a reported one-third of Square. Each of those holdings is worth at least $1 billion, according to the estimated valuations of both companies.

To his admirers, though, Dorsey's accomplishments aren't measured in dollars, but in influence and vision.

The parallels to

Apple's (

AAPL) cofounder are obvious: Both men were forced out of startups they launched, only to return and help lead them to new heights. Both men, after being ousted, started second companies that became powerhouses in their own rights (Pixar, in Jobs' case).

And both men became famous for a relentless focus on simple, elegant design: Even the pillars that support the new office's ceiling have been rounded to resemble Square's namesake plastic reader, which lets anyone accept credit cards via smartphone or tablet.

One way in which Dorsey differs from his role model: "He doesn't lose his temper," said Maja Henderson, who was Dorsey's executive assistant in Square's early days and now rides herd on the company's design and construction efforts. Those include the 150,000-square-foot headquarters, where employees avail themselves of such perks as in-house chiropractic care and unlimited vacation.

Henderson acknowledged that few "Squares" take much time off, although she said Dorsey "has gotten a lot better" about breaking away from work after a stretch in which he split 80 hours each week between Twitter and Square.

The Twitter creation myth has various versions, but the fundamental story is that Dorsey was working at a San Francisco podcasting startup, Odeo, in 2006 when he and several others cooked up a 140-character instant messaging system for mobile phones. Twitter spun out of Odeo with Dorsey as CEO, only to see a shake-up when co-founder and investor Evan Williams moved him aside amid much mutual finger-pointing.

Williams, in turn, was replaced in 2010 by Chief Operating Officer Dick Costolo, who brought Dorsey back in a product development role. Costolo said then that "having the inventor in the room" helped solve arguments about what the service should be.

With those debates more or less decided, Dorsey these days focuses most of his time on Square. He still spends Thursday afternoons at Twitter, where he's executive chairman and holds a weekly lunch with Costolo.

Steve Wilson, an analyst at Constellation Research, noted that Twitter essentially created a new category of communication before anyone realized it was needed. With Square, on the other hand, Dorsey identified a huge and lucrative problem with an existing market. In the United States alone, credit card payments are expected to hit $31 billion a year by 2016, according to an estimate by industry newsletter The Nilson Report.

"Amazing that no one thought to jump in before" to bring small merchants into that ecosystem, Wilson said. While he and others call Square a tempting acquisition target for a major financial services player, Dorsey insists he's building for the long haul.

To be sure, Square faces plenty of competition, from entrenched payments giants like Verifone and

eBay's (

EBAY) PayPal unit to startups like Clinkle -- which drew gasps around Silicon Valley in June by raising a $25 million "seed" round from titans including early

Facebook investor Jim Breyer and PayPal co-founder Peter Thiel. And here is my main idea we haven't even preceived the real potential of all these tech companies and start ups namely: Facebook,Twitter and Square to name a few.

"Square is primarily a credit card reader for your iPhone or Android device. To me, that's really not mobile payments," said Lucas Duplan, the 22-year-old who founded Clinkle last year with a bevy of other young Stanford University programmers.

Dorsey acknowledges that Square Wallet, which his company rolled out in 2011 to let consumers buy things via smartphone, has struggled for widespread acceptance despite two rebrandings. But he's content to focus on building services for small merchants, confident that the consumers eventually will follow.

"Jack holds true to his vision of empowering local business," said Mary Meeker, of

Kleiner PerkinsCaufield and Byers, who sits on Square's board along with fellow venture capital star

Vinod Khoslaand former U.S. Treasury Secretary Larry Summers.

Dorsey and Henderson applied that same sense of vision to their new offices, which take up parts of four floors in a dowdy former Bank of America data center. The theme is one of a miniature city, with conference rooms named for famous streets and a grand "boulevard" the length of two football fields.

But Dorsey said the headquarters is more than a pretty place. Much thought went into breaking the open floor plan into clusters, to preserve the camaraderie of a small company.

And in discussing the finished product, Dorsey said something that might sum up his entire approach to design: "It's not just about how it looks," he said. "It's about how it works."

Jack Dorsey's Square mobile payments company offers a growing suite of products:

Square Reader: Lets anyone accept credit cards via a smartphone or tablet for a 2.75 percent transaction fee.

Square Register: Helps merchants track payments, manage inventory and share menu information with customers.

Square Wallet: Allows consumers to pay at local businesses automatically via smartphone.

Square Market: Newest addition is an eBay-like marketplace that lets Square Register users set up online storefronts.

On Jack Dorsey's

Age: 36

Born: St. Louis

Education: Dropped out of New York University to launch his first Silicon Valley company in 2000.

Lives: San Francisco

Making history: In March 2006, Dorsey sent the world's first tweet: "just setting up my twitter."

Human touch: Takes every new Square employee on a walking tour of San Francisco.